Musical Chairs

While there are a few stack materials where there is only one supplier, usually a material ‘helper’ that increases the effectiveness of a key stack material, a number of OLED materials see considerable competition, particularly those that are not in the emitting layer, as both red and green phosphorescent OLED emitters are licensed and produced only by Universal Display (OLED), while emitter ‘host’ material in which the emitter is ‘doped’ are produced by a number of suppliers. As new stacks are developed by OLED producers material suppliers submit their latest materials for evaluation, with the intention of becoming or remaining a supplier of as many materials as possible in each new stack.

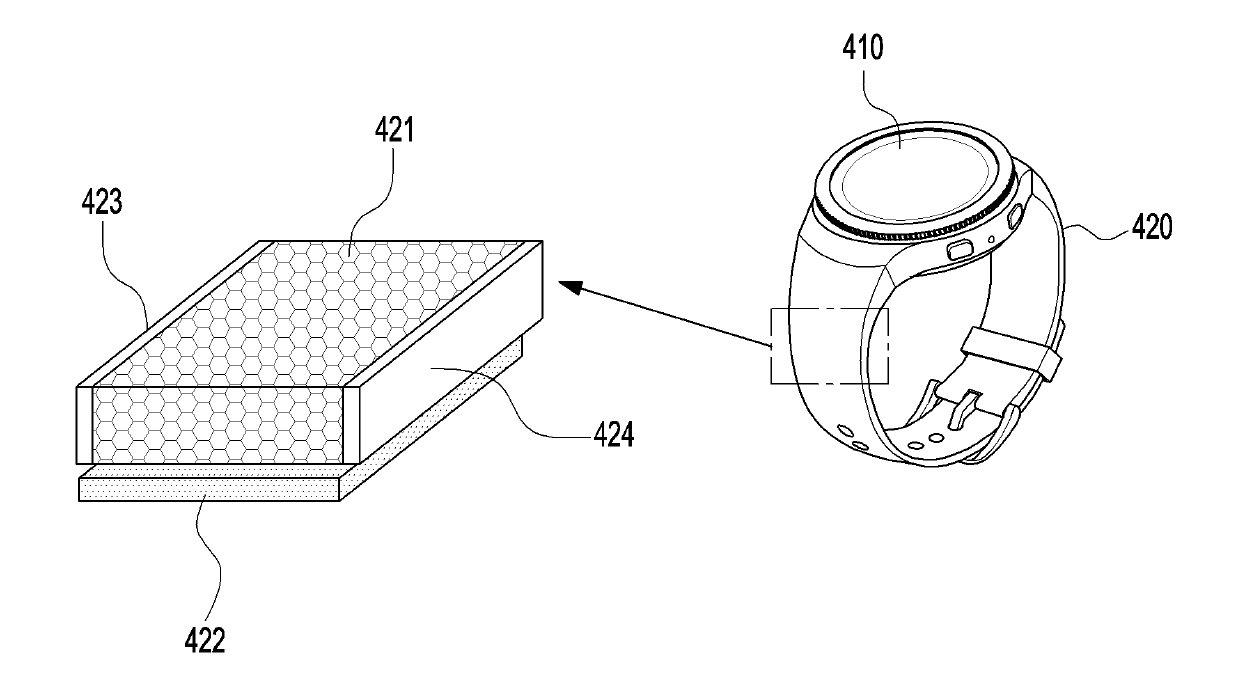

As we noted recently, Samsung Display will be updating its OLED stack later this year (M12) and there are already a few changes or additions to stack material suppliers. While we cannot confirm all material suppliers yet, there are a few that we believe are confirmed, and a number that we believe will be confirmed eventually. In the diagram below we show the typical OLED stack layers for Samsung’s most recent RGB OLED stacks (M10, M11) and M12 which will be adopted this year. Those suppliers that we can confirm in M12 are in black. Those that we believe will be chosen but have not confirmed are in red, and we note also that where multiple suppliers are listed, there is the possibility that a supplier for one SDC customer might be different from a supplier for another customer. We thank UBI, The Elec, and a number of suppliers for their contributions to the graphic.

RSS Feed

RSS Feed